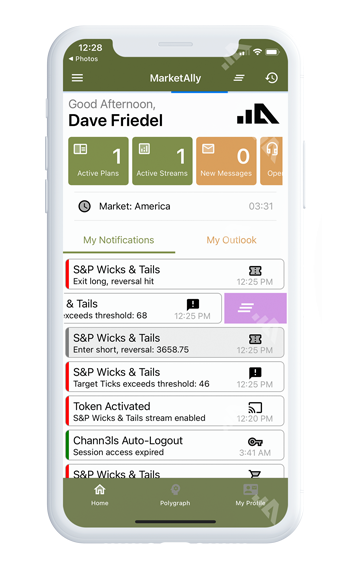

PolySymbols™ Features

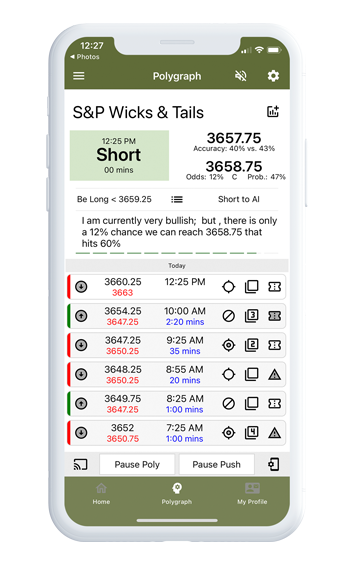

Trading streams built by, and for, elite day traders, this is the ultimate tool for gathering trading signals in real-time.

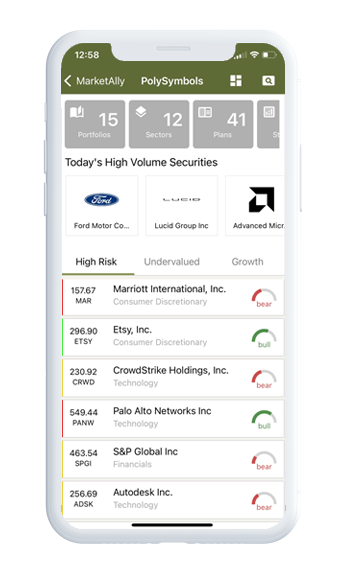

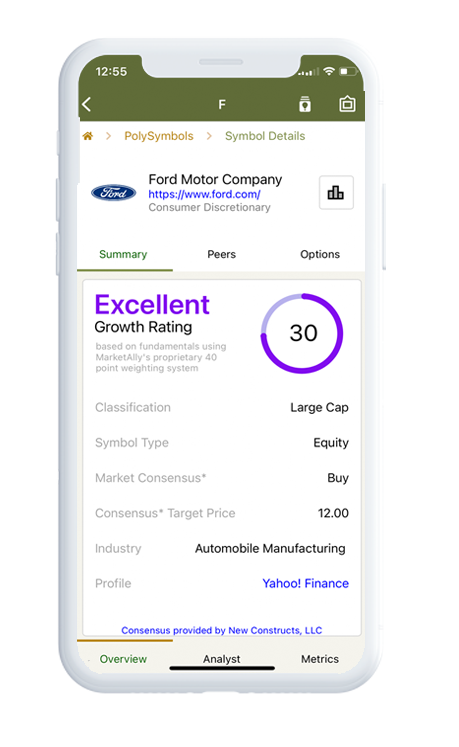

Growth Rating

Visually see how a security is relative to others

Market Consensus

Trading levels to watch for.

Market Peers

See companies that are in relation to one another.

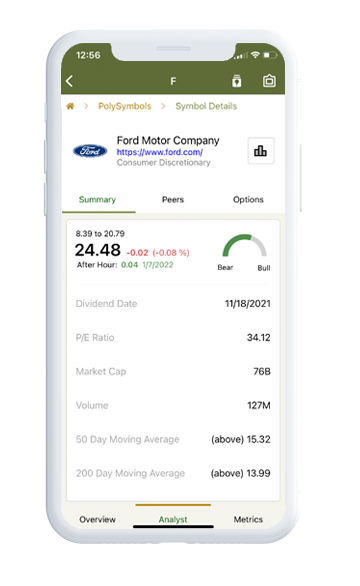

Analyst Review

A quick snapshot of technical analysis.

Quick Metrics

Review all the details of fundamentals easily.

Options Worksheet

Easily see the underlying mechanics around option chains.